How I Trade Order Flow In Forex

- Matt Crawford

- Feb 19

- 4 min read

Most traders who trade Forex have no idea what order flow is in the real sense of the word. They think order flow in forex is the same as things like "order blocks", a term coined by the trader/influencer ICT. This is really sad to see because most of the concepts introduced by influencers like ICT have been around for decades and most of it is just a combination of Market Profile concepts and order flow concepts used in futures.

In this piece I will introduce you to order flow in forex and particularly how I trade order flow in forex. Order flow can be used in many other markets not just the forex market; in fact I will argue that you should not be making a trade with out considering the order flow. By order flow I mean, time and sales and the level 2 DOM at the very least.

Order Flow In Forex Explained

So let's break this down.

The one thing you should understand is that Forex markets are suppose to be decentralised as an underlying asset but they have derivatives (options and futures) and these asset classes are traded from central exchanges. The presence of arbitrageurs (traders who monitor mispricing between spot and futures prices) means that the spot FX prices will move lock and step with the futures and options. So I argue that FX is very centralised and that's why we need to pay more attention to the central exchanges, where the futures are traded because those exchanges report volume and we are guaranteed to see futures move in the same direction as the spot. You can also use ETFs as well for the same purpose. A lot of currencies have ETF products tracking them.

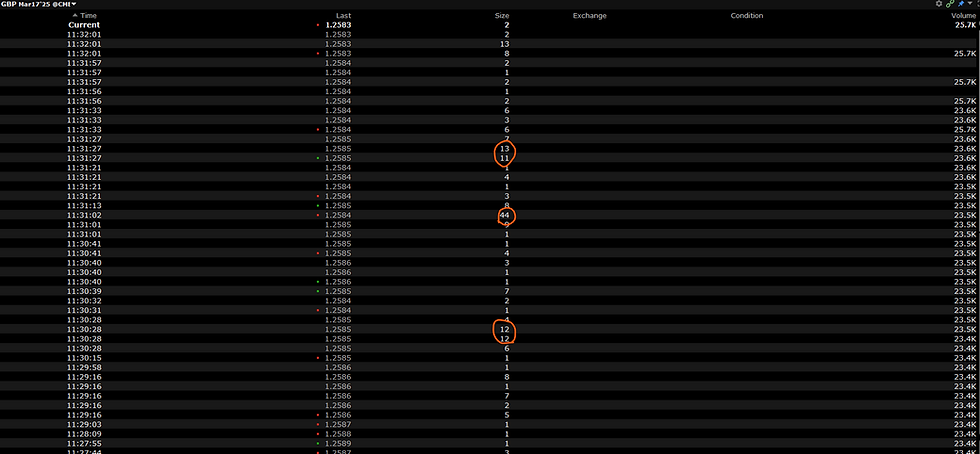

This gives us a significant advantage over technical analysis traders who often do not reference order flow at all. How? Below is a diagram of a time and sales for GBP futures.

I have circled over the largest orders that actually traded on the exchange. It is clear to see at 2585 a trade for 44 contracts (equivalent of 20 lots on spot FX sizing, futures contract size on Sterling is 62,500 GBP per contract as opposed to the standard 100k lots in spot FX) was placed. This means that one trader was long 44 contracts and another short. The market traded 2582 as the last trade done. One of these traders is in the money for $6.25 x 44 contracts = $275 x 3 ticks = $825 and the other is losing the same amount plus commission. Who do you think is winning?

As a trader, trading order flow in forex, you may want to consider a short position to ride the coat tails of what is a very large trade. There is also a reasonable chance that any trader who is willing to trade 44 contracts has a very good idea where the price will likely end up and if they are wrong, they will likely cut their losses very quickly. So we can assume a 10 pip move higher is a good place to have a stop.

This is a very simple example of how to use order in flow in Forex but is this how I use order flow in forex trading?

Yes, with a few layers of icing on the cake.

I first want to determine if the time or day is adequate to place a trade, for example. Is it a major centre open (London, Chicago, New York, etc)? If it is not I will not likely make the trade.

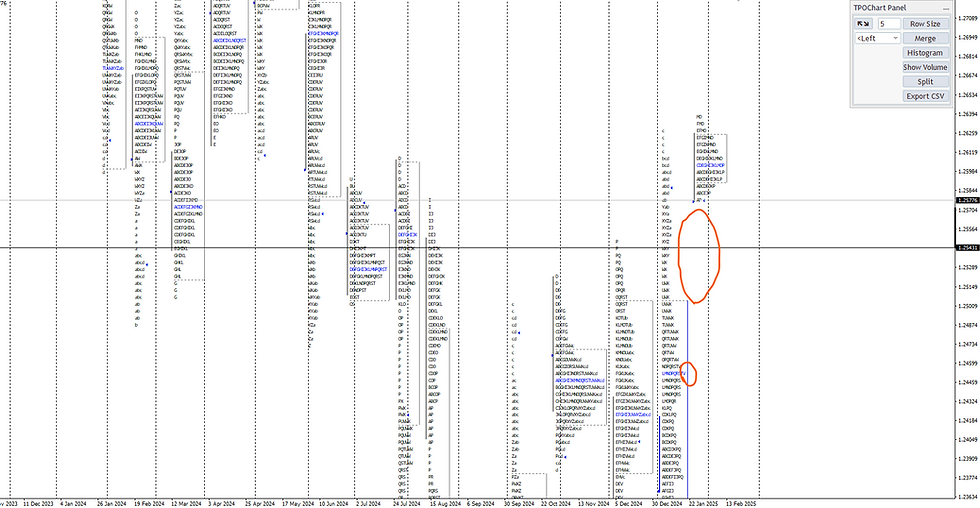

I would need to see using Market profile if there is a case for a big move in any direction. In the example below there is a really good case for this. As you can see a gap already exists and needs to be filled, so this will be a likely drop to 2500. There is also a visible naked POC. If you have not read What Is Market Profile Trading? now is a good time.

The last thing I consider is trade location relative to where I am seeing the order flow. If the market has been falling for a while and huge orders are trading, this could mean a short cover especially if these trades are not moving the price fast enough. That's just thing, if a trader is trading large size, they may be chasing a bigger move and don't care what price they trade at, so you can't just blindly follow the order flow (tape or time and sales).

So what do we get from all of this? Well, you have to understand that looking at the order flow in forex is crucial even if you are a swing trader and don't trade intraday, it is incredibly important for you to gauge the tempo. I once saw a 140 contract trade on Cable (GBP Futures) and within minutes the Pound was down nearly 100 pips across both spot, futures and options. Do you think this is a coincidence? I don't.

If you think I have added value to your trading journey today, you can follow me on my Discord Server. I provide a lot more value to new and old traders for free. If you want access to my Market Profile tool and want more information please use this form.