Order Flow And Price Action, The Difference

- Matt Crawford

- Feb 21

- 2 min read

As a new trader you are probably hearing a lot about order flow and price action trading and you are not sure what the difference is between order flow and price action. That's okay, because that is precisely what I am going to breakdown for you.

A good place to start would be, "what is order flow?" A good idea will be to read How Order Flow Trading Works. I will give you a snippet. Order flow trading is looking at transaction date through the time and sales as a mechanism to make trading decisions. Order flow data can be organised into footprint charts or viewed in raw format on the time and sales or tape or visualized in conjunction with the orderbook so called level 2 depth of market (DOM).

Now, what is price action trading? This is the when a trader uses some kind of visual graphic representation of price without the reliance on any other kind of data to make trading decisions. Typically, traders will use candlestick charts, Market Profile charts or even older point and figure charts to understand where the market is going. This is what is called pure price action trading. I use TPO charts to analyse price action and if you have never heard of TPO, then it's a good time to read What Is TPO Charting?

At this point, you should be able to tell the difference between order flow and price action. If you can't then I would suggest join the Discord server, I post lots of examples on both order flow trading decisions and price action through Market Profile.

What's The Difference Between Order Flow and Price Action

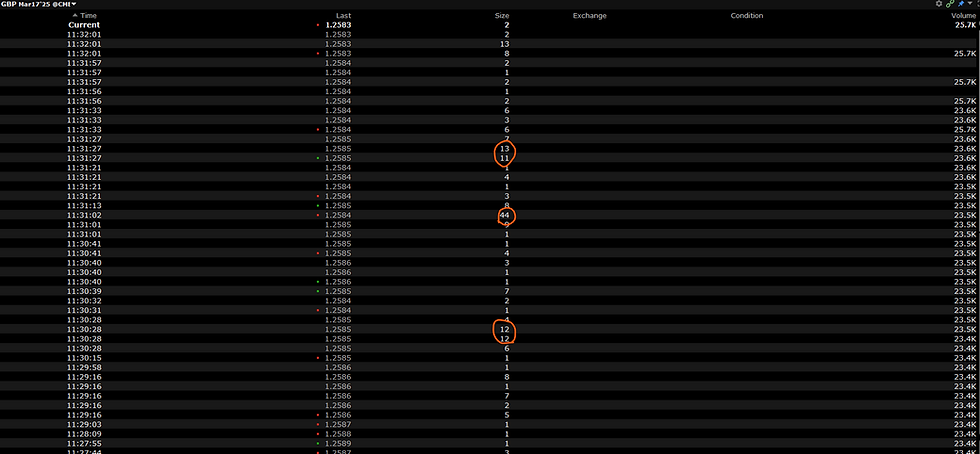

Below you can see a typical order flow based time and sales. This is the time and sales for Pound futures.

Below is a candlestick based price action chart of Corn futures next to an order flow based time and sales.